Ethereum is currently dominating the cryptocurrency market in more ways than one. The network seems to be heading towards one of its most promising stages. Recently, there has been a significant drop in the gas price (Gwei) of Ethereum.

As a cryptocurrency observer noted, the last time the network recorded a gas price this low was back in 2020. Since then, Ethereum has crossed many notable milestones, some of which includes it outperforming the Bitcoin network.

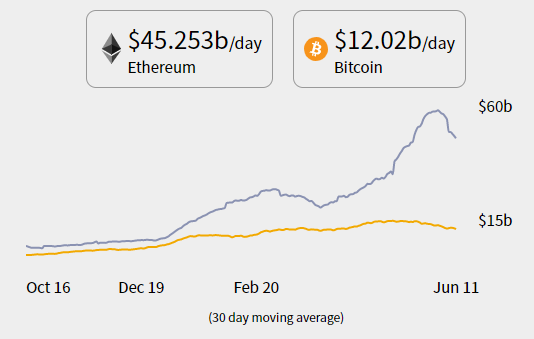

Ethereum’s daily transaction volume knocks out Bitcoin

The daily transactions carried out on the Ethereum network have surpassed that of the bitcoin network by a large margin. The transaction volume has surged since December 19th, hitting a new high on the 11th of June this year, and bringing the total number of daily transactions to $45.253 billion, while Bitcoin’s daily transaction volume sits at $12.02 billion.

This year, Ethereum 2.0 received criticism for its ability to scale and solve the many problems of the Ethereum network. The delay in the system upgrade caused a major uproar amongst crypto proponents who branded the upgrade as a failed project. But in an impressive turnout of events, as an analyst puts it, there is currently “$14 billion in ETH betting on the launch of ETH2.”

Bitcoin on Ethereum is as commendable as it is alarming

The supply of Bitcoin on the Ethereum network has also increased greatly. Back in 2020, there were only nearly 1000 Bitcoins on the Ethereum network. At this time, however, there are currently well over 230,000 BTCs on the network, which is over 1% of the total Bitcoin supply.

Meanwhile, DeFi’s use cases over the past months have been reflective of its diverse structure, which goes to amplify its value as unique technology. Analyst Nick Chong noted the growth of DeFi over the past year saying:

“Thematically, early 2020 DeFi was primarily focused on one thing: borrowing, primarily through MakerDAO. Today, we’ve seen the use cases for DeFi expand to trading, synthetics, asset management, and more. And there’s more to come. Derivatives.”

It is important to note that the arrival of Polygon, BSC, and Solana may have influenced Ethereum’s gas fee reduction and price dips. However, Chong asserts that DeFi is still holding the network up. The full blocks on Polygon are, according to him, proof of DeFi’s success. He concludes that with billions locked in smart contracts, the future of Ethereum is as bright as ever.

via ZyCrypto